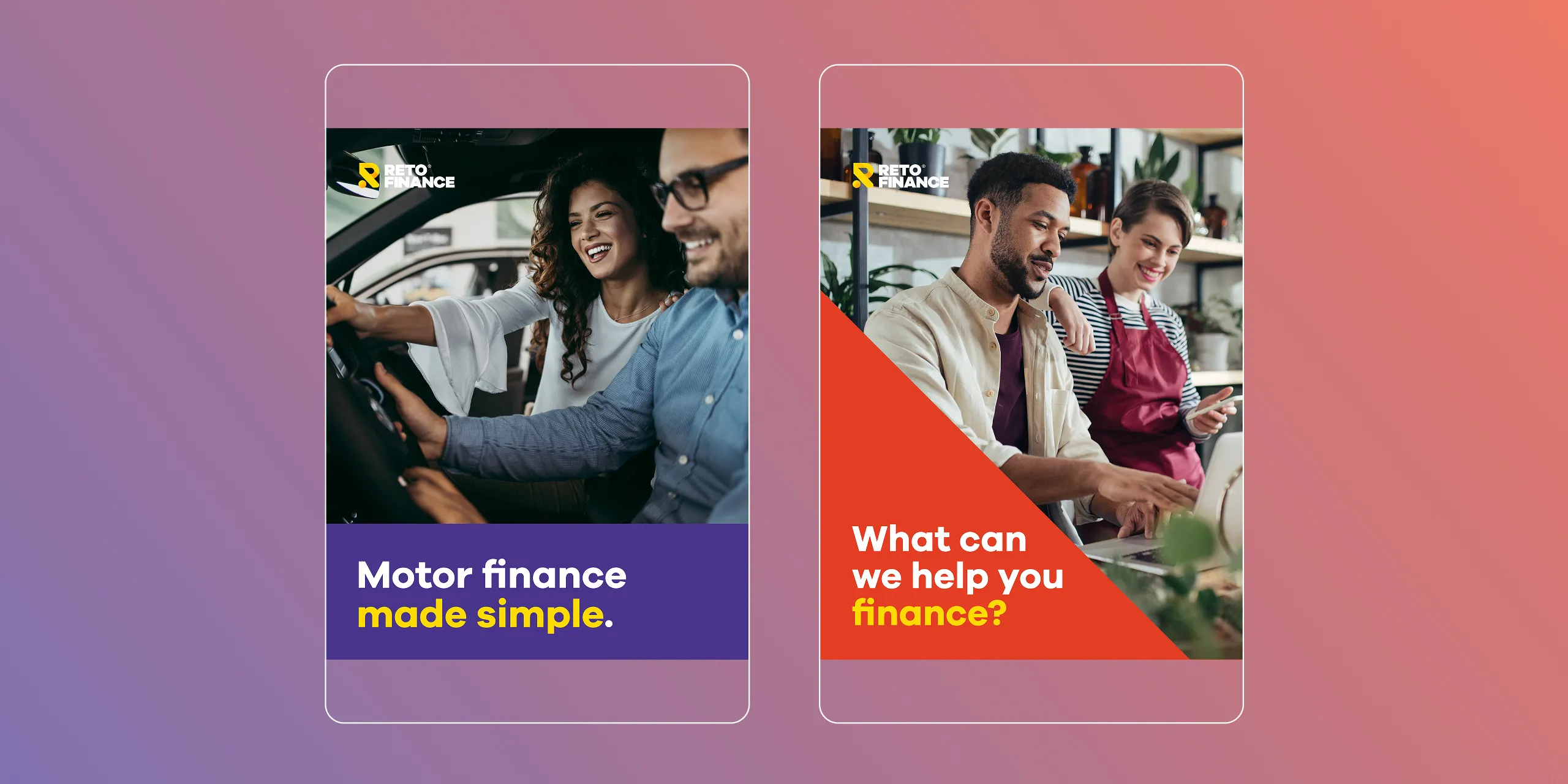

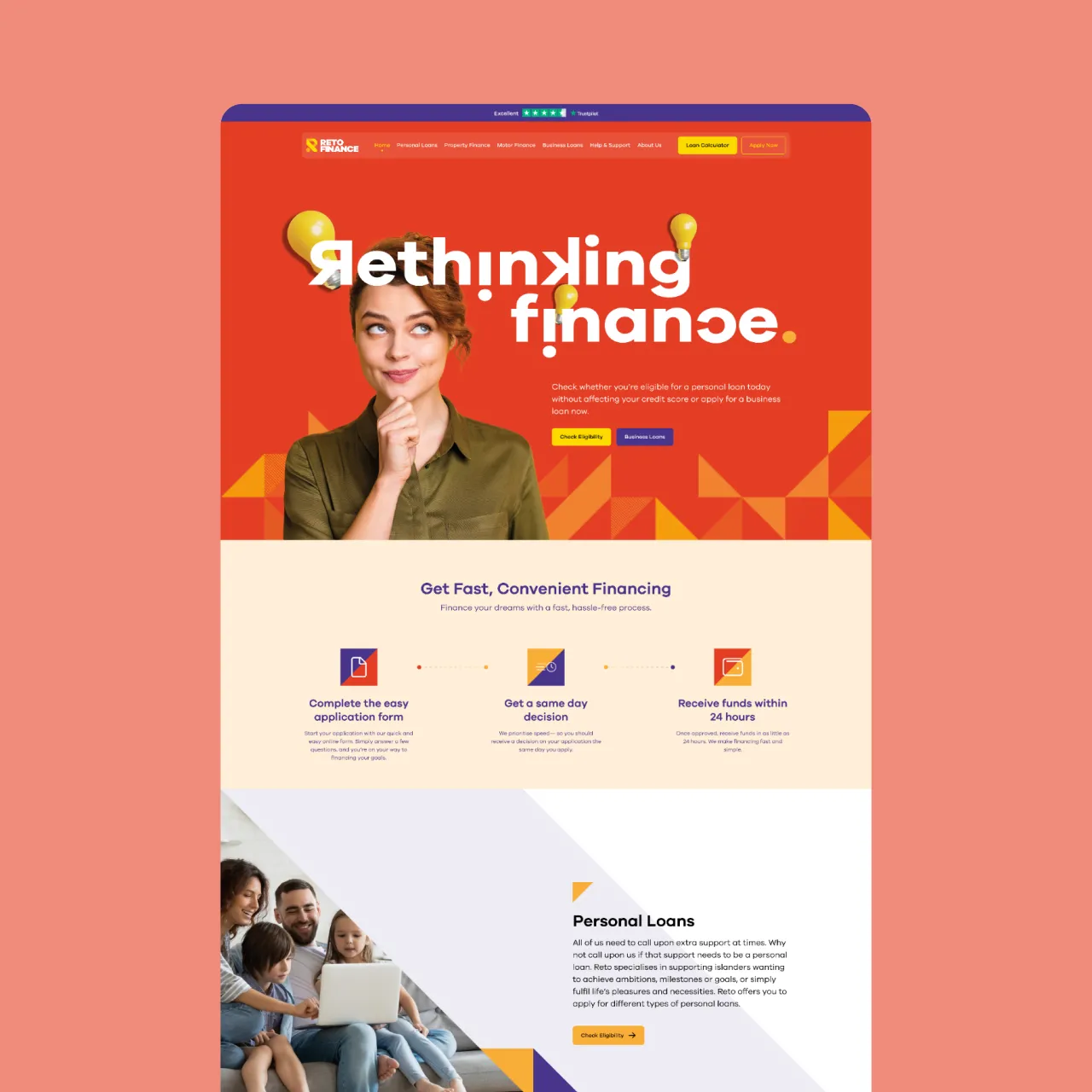

When Reto Finance first approached Twilo, their new brand had yet to make it online. The existing website didn’t reflect their identity, which risked losing enquiries and confusing customers who had come to the website after seeing an offline advertisement. To deliver the consistency required we created a modern, user-friendly site that seamlessly carried their refreshed look across web, print, and billboard campaigns. Every customer interaction now feels connected, from first click to final conversion.

Financial products demand confidence. The new website was designed with simplicity in mind, guiding users clearly through their options. We used reassuring language, clean layouts, and transparent calls-to-action to build trust at every stage of the journey, ensuring visitors always knew where they were and what to do next.